| Part of a series on statistics |

| Probability theory |

|---|

|

In probability theory and related fields, a stochastic (/stəˈkæstɪk/) or random process is a mathematical object usually defined as a sequence of random variables in a probability space, where the index of the sequence often has the interpretation of time. Stochastic processes are widely used as mathematical models of systems and phenomena that appear to vary in a random manner. Examples include the growth of a bacterial population, an electrical current fluctuating due to thermal noise, or the movement of a gas molecule.[1][4][5] Stochastic processes have applications in many disciplines such as biology,[6] chemistry,[7] ecology,[8] neuroscience,[9] physics,[10] image processing, signal processing,[11] control theory,[12] information theory,[13] computer science,[14] and telecommunications.[15] Furthermore, seemingly random changes in financial markets have motivated the extensive use of stochastic processes in finance.[16][17][18]

Applications and the study of phenomena have in turn inspired the proposal of new stochastic processes. Examples of such stochastic processes include the Wiener process or Brownian motion process,[a] used by Louis Bachelier to study price changes on the Paris Bourse,[21] and the Poisson process, used by A. K. Erlang to study the number of phone calls occurring in a certain period of time.[22] These two stochastic processes are considered the most important and central in the theory of stochastic processes,[1][4][23] and were invented repeatedly and independently, both before and after Bachelier and Erlang, in different settings and countries.[21][24]

The term random function is also used to refer to a stochastic or random process,[25][26] because a stochastic process can also be interpreted as a random element in a function space.[27][28] The terms stochastic process and random process are used interchangeably, often with no specific mathematical space for the set that indexes the random variables.[27][29] But often these two terms are used when the random variables are indexed by the integers or an interval of the real line.[5][29] If the random variables are indexed by the Cartesian plane or some higher-dimensional Euclidean space, then the collection of random variables is usually called a random field instead.[5][30] The values of a stochastic process are not always numbers and can be vectors or other mathematical objects.[5][28]

Based on their mathematical properties, stochastic processes can be grouped into various categories, which include random walks,[31] martingales,[32] Markov processes,[33] Lévy processes,[34] Gaussian processes,[35] random fields,[36] renewal processes, and branching processes.[37] The study of stochastic processes uses mathematical knowledge and techniques from probability, calculus, linear algebra, set theory, and topology[38][39][40] as well as branches of mathematical analysis such as real analysis, measure theory, Fourier analysis, and functional analysis.[41][42][43] The theory of stochastic processes is considered to be an important contribution to mathematics[44] and it continues to be an active topic of research for both theoretical reasons and applications.[45][46][47]

YouTube Encyclopedic

-

1/5Views:884 14988 69955 988269 75723 796

-

5. Stochastic Processes I

-

L21.3 Stochastic Processes

-

What is a Random Process?

-

What is a Random Walk? | Infinite Series

-

Stochastic Processes

Transcription

The following content is provided under a Creative Commons license. Your support will help MIT OpenCourseWare continue to offer high quality educational resources for free. To make a donation or view additional materials from hundreds of MIT courses, visit MIT OpenCourseWare at ocw.mit.edu. PROFESSOR: Today we're going to study stochastic processes and, among them, one type of it, so discrete time. We'll focus on discrete time. And I'll talk about what it is right now. So a stochastic process is a collection of random variables indexed by time, a very simple definition. So we have either-- let's start from 0-- random variables like this, or we have random variables given like this. So a time variable can be discrete, or it can be continuous. With these ones, we'll call discrete time stochastic processes, and these ones continuous time. So for example, a discrete time random variable can be something like-- and so on. So these are the values, x0, x1, x2, x3, and so on. And they are random variables. This is just one-- so one realization of the stochastic process. But all these variables are supposed to be random. And then a continuous time random variable-- a continuous time stochastic process can be something like that. And it doesn't have to be continuous, so it can jump and it can jump and so on. And all these values are random values. So that's just a very informal description. And a slightly different point of view, which is slightly preferred, when you want to do some math with it, is that-- alternative definition-- it's a probability distribution over paths, over a space of paths. So you have all a bunch of possible paths that you can take. And you're given some probability distribution over it. And then that will be one realization. Another realization will look something different and so on. So this one-- it's more a intuitive definition, the first one, that it's a collection of random variables indexed by time. But that one, if you want to do some math with it, from the formal point of view, that will be more helpful. And you'll see why that's the case later. So let me show you some more examples. For example, to describe one stochastic process, this is one way to describe a stochastic process. t with-- let me show you three stochastic processes, so number one, f t equals t. And this was probability 1. Number 2, f t is equal to t, for all t, with probability 1/2, or f t is equal to minus t, for all t, with probability 1/2. And the third one is, for each t, f t is equal to t or minus t, with probability 1/2. The first one is quite easy to picture. It's really just-- there's nothing random in here. This happens with probability 1. Your path just says f t equals t. And we're only looking at t greater than or equal to 0 here. So that's number 1. Number 2, it's either this one or this one. So it is a stochastic process. If you think about it this way, it doesn't really look like a stochastic process. But under the alternative definition, you have two possible paths that you can take. You either take this path, with 1/2, or this path, with 1/2. Now, at each point, t, your value x t is a random variable. It's either t or minus t. And it's the same for all t. But they are dependent on each other. So if you know one value, you automatically know all the other values. And the third one is even more interesting. Now, for each t, we get rid of this dependency. So what you'll have is these two lines going on. I mean at every single point, you'll be either a top one or a bottom one. But if you really want draw the picture, it will bounce back and forth, up and down, infinitely often, and it'll just look like two lines. So I hope this gives you some feeling about stochastic processes, I mean, why we want to describe it in terms of this language, just a tiny bit. Any questions? So, when you look at a process, when you use a stochastic process to model a real life something going on, like a stock price, usually what happens is you stand at time t. And you know all the values in the past-- know. And in the future, you don't know. But you want to know something about it. You want to have some intelligent conclusion, intelligent information about the future, based on the past. For this stochastic processes, it's easy. No matter where you stand at, you exactly know what's going to happen in the future. For this one, it's also the same. Even though it's random, once you know what happened at some point, you know it has to be this distribution or this line, if it's here, and this line if it's there. But that one is slightly different. No matter what you know about the past, even if know all the values in the past, what happened, it doesn't give any information at all about the future. Though it's not true if I say any information at all. We know that each value has to be t or minus t. You just don't know what it is. So when you're given a stochastic process and you're standing at some time, your future, you don't know what the future is, but most of the time you have at least some level of control given by the probability distribution. Here, it was, you can really determine the line. Here, because of probability distribution, at each point, only gives t or minus t, you know that each of them will be at least one of the points, but you don't know more than that. So the study of stochastic processes is, basically, you look at the given probability distribution, and you want to say something intelligent about the future as t goes on. So there are three types of questions that we mainly study here. So a, first type, is what are the dependencies in the sequence of values. For example, if you know the price of a stock on all past dates, up to today, can you say anything intelligent about the future stock prices-- those type of questions. And b is what is the long term behavior of the sequence? So think about the law of large numbers that we talked about last time or central limit theorem. And the third type, this one is left relevant for our course, but, still, I'll just write it down. What are the boundary events? How often will something extreme happen, like how often will a stock price drop by more than 10% for a consecutive 5 days-- like these kind of events. How often will that happen? And for a different example, like if you model a call center and you want to know, over a period of time, the probability that at least 90% of the phones are idle or those kind of things. So that's was an introduction. Any questions? Then there are really lots of stochastic processes. One of the most important ones is the simple random walk. So today, I will focus on discrete time stochastic processes. Later in the course, we'll go on to continuous time stochastic processes. And then you'll see like Brownian motions and-- what else-- Ito's lemma and all those things will appear later. Right now, we'll study discrete time. And later, you'll see that it's really just-- what is it-- they're really parallel. So this simple random walk, you'll see the corresponding thing in continuous time stochastic processes later. So I think it's easier to understand discrete time processes, that's why we start with it. But later, it will really help if you understand it well. Because for continuous time, it will just carry over all the knowledge. What is a simple random walk? Let Yi be IID, independent identically distributed, random variables, taking values 1 or minus 1, each with probability 1/2. Then define, for each time t, X sub t as the sum of Yi, from i equals 1 to 2. Then the sequence of random variables, and X0 is equal to 0. X0, X1, X2, and so on is called a one-dimensional, simple random walk. But I'll just refer to it as simple random walk or random walk. And this is a definition. It's called simple random walk. Let's try to plot it. At time 0, we start at 0. And then, depending on the value of Y1, you will either go up or go down. Let's say we went up. So that's at time 1. Then at time 2, depending on your value of Y2, you will either go up one step from here or go down one step from there. Let's say we went up again, down, 4, up, up, something like that. And it continues. Another way to look at it-- the reason we call it a random walk is, if you just plot your values of Xt, over time, on a line, then you start at 0, you go to the right, right, left, right, right, left, left, left. So the trajectory is like a walk you take on this line, but it's random. And each time you go to the right or left, right or left, right or left. So that was two representations. This picture looks a little bit more clear. Here, I just lost everything I draw. Something like that is the trajectory. So from what we learned last time, we can already say something intelligent about the simple random walk. For example, if you apply central limit theorem to the sequence, what is the information you get? So over a long time, let's say t is way, far away, like a huge number, a very large number, what can you say about the distribution of this at time t? AUDIENCE: Is it close to 0? PROFESSOR: Close to 0. But by close to 0, what do you mean? There should be a scale. I mean some would say that 1 is close to 0. Some people would say that 100 is close to 0, so do you have some degree of how close it will be to 0? Anybody? AUDIENCE: So variance will be small. PROFESSOR: Sorry? AUDIENCE: The variance will be small. PROFESSOR: Variance will be small. About how much will the variance be? AUDIENCE: 1 over n. PROFESSOR: 1 over n. 1 over n? AUDIENCE: Over t. PROFESSOR: 1 over t? Anybody else want to have a different? AUDIENCE: [INAUDIBLE]. PROFESSOR: 1 over square root t probably would. AUDIENCE: [INAUDIBLE]. AUDIENCE: The variance would be [INAUDIBLE]. PROFESSOR: Oh, you're right, sorry. Variance will be 1 over t. And the standard deviation will be 1 over square root of t. What I'm saying is, by central limit theorem. AUDIENCE: [INAUDIBLE]. Are you looking at the sums or are you looking at the? PROFESSOR: I'm looking at the Xt. Ah. That's a very good point-- t and square root of t. Thank you. AUDIENCE: That's very different. PROFESSOR: Yeah, very, very different. I was confused. Sorry about that. The reason is because Xt, 1over the square root of t times Xt-- we saw last time that this, if t is really, really large, this is close to the normal distribution, 0,1. So if you just look at it, Xt over the square root of t will look like normal distribution. That means the value, at t, will be distributed like a normal distribution, with mean 0 and variance square root of t. So what you said was right. It's close to 0. And the scale you're looking at is about the square root of t. So it won't go too far away from 0. That means, if you draw these two curves, square root of t and minus square root of t, your simple random walk, on a very large scale, won't like go too far away from these two curves. Even though the extreme values it can take-- I didn't draw it correctly-- is t and minus t, because all values can be 1 or all values can be minus 1. Even though, theoretically, you can be that far away from your x-axis, in reality, what's going to happen is you're going to be really close to this curve. You're going to play within this area, mostly. AUDIENCE: I think that [INAUDIBLE]. PROFESSOR: So, yeah, that was a very vague statement. You won't deviate too much. So at the 100 square root of t, you will be inside this interval like 90% of the time. If you take this to be 10,000 times square root of t, almost 99.9% or something like that. And there's even a theorem saying you will hit these two lines infinitely often. So if you go over time, a very long period, for a very, very long, you live long enough, then, even if you go down here. Even, in this picture, you might think, OK, in some cases, it might be the case that you always play in the negative region. But there's a theorem saying that that's not the case. With probability 1, if you go to infinity, you will cross this line infinitely often. And in fact, you will meet these two lines infinitely often. So those are some interesting things about simple random walk. Really, there are lot more interesting things, but I'm just giving an overview, in this course, now. Unfortunately, I can't talk about all of these fun stuffs. But let me still try to show you some properties and one nice computation on it. So some properties of a random walk, first, expectation of Xk is equal to 0. That's really easy to prove. Second important property is called independent increment. So if look at these times, t0, t1, up to tk, then random variables X sub ti plus 1 minus X sub ti are mutually independent. So what this says is, if you look at what happens from time 1 to 10, that is irrelevant to what happens from 20 to 30. And that can easily be shown by the definition. I won't do that, but we'll try to do it as an exercise. Third one is called stationary, so it has the property. That means, for all h greater or equal to 0, and t greater than or equal to 0-- h is actually equal to 1-- the distribution of Xt plus h minus Xt is the same as the distribution of X sub h. And again, this easily follows from the definition. What it says is, if you look at the same amount of time, then what happens inside this interval is irrelevant of your starting point. The distribution is the same. And moreover, from the first part, if these intervals do not overlap, they're independent. So those are the two properties that we're talking here. And you'll see these properties appearing again and again. Because stochastic processes having these properties are really good, in some sense. They are fundamental stochastic processes. And simple random walk is like the fundamental stochastic process. So let's try to see one interesting problem about simple random walk. So example, you play a game. It's like a coin toss game. I play with, let's say, Peter. So I bet $1 at each turn. And then Peter tosses a coin, a fair coin. It's either heads or tails. If it's heads, he wins. He wins the $1. If it's tails, I win. I win $1. So from my point of view, in this coin toss game, at each turn my balance goes up by $1 or down by $1. And now, let's say I started from $0.00 balance, even though that's not possible. Then my balance will exactly follow the simple random walk, assuming that the coin it's a fair coin, 50-50 chance. Then my balance is a simple random walk. And then I say the following. You know what? I'm going to play. I want to make money. So I'm going to play until I win $100 or I lose $100. So let's say I play until I win $100 or I lose $100. What is the probability that I will stop after winning $100? AUDIENCE: 1/2. PROFESSOR: 1/2 because? AUDIENCE: [INAUDIBLE]. PROFESSOR: Yes. So happens with 1/2, 1/2. And this is by symmetry. Because every chain of coin toss, which gives a winning sequence, when you flip it, it will give a losing sequence. We have one to one correspondence between those two things. That was good. Now if I change it. What if I say I will win $100 or I lose $50? What if I play until win $100 or lose $50? In other words, I look at the random walk, I look at the first time that it hits either this line or it hits this line, and then I stop. What is the probability that I will stop after winning $100? AUDIENCE: [INAUDIBLE]. PROFESSOR: 1/3? Let me see. Why 1/3? AUDIENCE: [INAUDIBLE]. PROFESSOR: So you're saying, hitting this probability is p. And the probability that you hit this first is p, right? It's 1/2, 1/2. But you're saying from here, it's the same. So it should be 1/4 here, 1/2 times 1/2. You've got a good intuition. It is 1/3, actually. AUDIENCE: [INAUDIBLE]. PROFESSOR: And then once you hit it, it's like the same afterwards? I'm not sure if there is a way to make an argument out of it. I really don't know. There might be or there might not be. I'm not sure. I was thinking of a different way. But yeah, there might be a way to make an argument out of it. I just don't see it right now. So in general, if you put a line B and a line A, then probability of hitting B first is A over A plus B. And the probability of hitting this line, minus A, is B over A plus B. And so, in this case, if it's 100 and 50, it's 100 over 150, that's 2/3 and that's 1/3. This can be proved. It's actually not that difficult to prove it. I mean it's hard to find the right way to look at it. So fix your B and A. And for each k between minus A and B define f of k as the probability that you'll hit-- what is it-- this line first, and the probability that you hit the line B first when you start at k. So it kind of points out what you're saying. Now, instead of looking at one fixed starting point, we're going to change our starting point and look at all possible ways. So when you start at k, I'll define f of k as the probability that you hit this line first before hitting that line. What we are interested in is computing f 0. What we know is f of B is equal to 1, f of minus A is equal to 0. And then actually, there's one recursive formula that matters to us. If you start at f k, you either go up or go down. You go up with probability 1/2. You go down with probability 1/2. And now it starts again. Because of this-- which one is it-- stationary property. So starting from here, the probability that you hit B first it exactly f of k plus 1. So if you go up, the probability that you hit B first is f of k plus 1. If you go down, it's f of k minus 1. And then that gives you a recursive formula with two boundary values. If you look at it, you can solve it. When you solve it, you'll get that answer. So I won't go into details, but what I wanted to show is that simple random walk is really this property, these two properties. It has these properties and even more powerful properties. So it's really easy to control. And at the same, time it's quite universal. It can model-- like it's not a very weak model. It's rather restricted, but it's a really good model for like a mathematician. From the practical point of view, you'll have to twist some things slightly and so on. But in many cases, you can approximate it by simple random walk. And as you can see, you can do computations, with simple random walk, by hand. So that was it. I talked about the most important example of stochastic process. Now, let's talk about more stochastic processes. The second one is called the Markov chain. Let me right that part, actually. So Markov chain, unlike the simple random walk, is not a single stochastic process. A stochastic process is called a Markov chain if has some property. And what we want to capture in Markov chain is the following statement. These are a collection of stochastic processes having the property that-- whose effect of the past on the future is summarized only by the current state. That's quite a vague statement. But what we're trying to capture here is-- now, look at some generic stochastic process at time t. You know all the history up to time t. You want to say something about the future. Then, if it's a Markov chain, what it's saying is, you don't even have know all about this. Like this part is really irrelevant. What matters is the value at this last point, last time. So if it's a Markov chain, you don't have to know all this history. All you have to know is this single value. And all of the effect of the past on the future is contained in this value. Nothing else matters. Of course, this is a very special type of stochastic process. Most other stochastic processes, the future will depend on the whole history. And in that case, it's more difficult to analyze. But these ones are more manageable. And still, lots of interesting things turn out to be Markov chains. So if you look at simple random walk, it is a Markov chain, right? So simple random walk, let's say you went like that. Then what happens after time t really just depends on how high this point is at. What happened before doesn't matter at all. Because we're just having new coin tosses every time. That this value can affect the future, because that's where you're going to start your process from. Like that's where you're starting your process. So that is a Markov chain. This part is irrelevant. Only the value matters. So let me define it a little bit more formally. A discrete time stochastic process is a Markov chain if the probability that X at some time, t plus 1, is equal to something, some value, given the whole history up to time n is equal to the probability that Xt plus 1 is equal to that value, given the value X sub n for all n greater than or equal to-- t-- greater than or equal to 0 and all s. This is a mathematical way of writing down this. The value at Xt plus 1, given all the values up to time t, is the same as the value at time t plus 1, the probability of it, given only the last value. And the reason simple random walk is a Markov chain is because both of them are just 1/2. I mean, if it's for-- let me write it down. So example, random walk probability that Xt plus 1 equal to s, given t is equal to 1/2, if s is equal Xt plus 1 or Xt minus 1, and 0 otherwise. So it really depends only on the last value of Xt. Any questions? All right. If there is case when you're looking at a stochastic process, a Markov chain, and all Xi have values in some set s, which is finite, a finite set, in that case, it's really easy to describe Markov chains. So now denote the probability ij as the probability that, if at that time t you are at i, the probability that you jump to j at time t plus 1 for all pair of points i, j. I mean, it's a finite set, so I might just as well call it the integer set from 1 to m, just to make the notation easier. Then, first of all, if the sum over all j and s, Pij, that is equal to 1. Because if you start at i, you'll have to jump to somewhere in your next step. So if you sum over all possible states you can have, you have to sum up to 1. And really, a very interesting thing is this matrix called the transition probability matrix, defined as. So we put Pij at [INAUDIBLE] and [INAUDIBLE]. And really, this tells you everything about the Markov chain. Everything about the stochastic process is contained in this matrix. That's because a future state only depends on the current state. So if you know what happens at time t, where it's at time t, look at the matrix, you can decode all the information you want. What is the probability that it will be at-- let's say, it's at 0 right now. What's the probability that it will jump to 1 at the next time? Just look at 0 comma 1, here. There is no 0, 1, here, so it's 1 and 2. Just look at 1 and 2, 1 and 2, i and j. Actually, I made a mistake. That should be the right one. Not only that, that's a one-step. So what happened is it describes what happens in a single step, the probability that you jump from i to j. But using that, you can also model what's the probability that you jump from i to j in two steps. So let's define q sub i j as the probability that X at time t plus 2 is equal to j, given that X at time t is equal to i. Then the matrix, defined this way, can you describe it in terms of the matrix A? Anybody? Multiplication? Very good. So it's A square. Why is it? So let me write this down in a different way. qij is-- you sum over all intermediate values-- the probability that you jump from i to k, first, and then the probability that you jump from k to j. And if you look at what this means, each entry here is described by a linear-- what is it-- the dot product of a column and a row. And that's exactly what occurs. And if you want to look at the three-step, four-step, all you have to do is just multiply it again and again and again. Really, this matrix contains all the information you want if you have a Markov chain and its finite. That's very important. For random walk, simple random walk, I told you that it is a Markov chain. But it does not have a transition probability matrix, because the state space is not finite. So be careful. However, finite Markov chains, really, there's one matrix that describes everything. I mean, I said it like it's something very interesting. But if you think about it, you just wrote down all the probabilities. So it should describe everything. So an example. You have a machine, and it's broken or working at a given day. That's a silly example. So if it's working today, working tomorrow, broken with probability 0.01, working with probability 0.90. If it's broken, the probability that it's repaired on the next day is 0.8. And it's broken at 0.2. Suppose you have something like this. This is an example of a Markov chain used in like engineering applications. In this case, s is also called a sample state space, actually. And the reason is because, in many cases, what you're modeling is these kind of states of some system, like broken or working, rainy, sunny, cloudy as weather. And all these things that you model represent states a lot of time. So you call it state set as well. So that's an example. And let's see what happens for this matrix. We have two states, working and broken. Working to working is 0.99. Working to broken is 0.01. Broken to working is 0.8. Broken to broken is 0.2. So that's what we've learned so far. And the question, what happens if you start from some state, let's say it was working today, and you go a very, very long time, like a year or 10 years, then the distribution, after 10 years, on that day, is A to the 3,650. So that will be that times 1, 0 will be the probability p, q. p will be the probability that it's working at that time. q will be the probability that it's broken at that time. What will p and q be? What will p and q be? That's the question that we're trying to ask. We didn't learn, so far, how to do this, but let's think about it. I'm going to cheat a little bit and just say, you know what, I think, over a long period of time, the probability distribution on day 3,650 and that on day 3,651 shouldn't be that different. They should be about the same. Let's make that assumption. I don't know if it's true or not. Well, I know it's true, but that's what I'm telling you. Under that assumption, now you can solve what p and q are. So approximately, I hope, p, q-- so A 3,650, 1, 0 is approximately the same as A to the 3,651, 1, 0. That means that this is p, q. p, q is about the same as A times p, q. Anybody remember what this is? Yes. So p, q will be the eigenvector of this matrix. Over a long period of time, the probability distribution that you will observe will be the eigenvector. And whats the eigenvalue? 1, at least in this case, it looks like it's 1. Now I'll make one more connection. Do you remember Perron-Frobenius theorem? So this is a matrix. All entries are positive. So there is a largest eigenvalue, which is positive and real. And there is on all positive eigenvector corresponding to it. What I'm trying to say is that's going to be your p, q. But let me not jump to the conclusion yet. And one more thing we know is, by Perron-Frobenius, there exists an eigenvalue, the largest one, lambda greater than 0, and eigenvector v1, v2, where v1, v2 are positive. Moreover, lambda was a multiplicity of 1. I'll get back to it later. So let's write this down. A times v1, v2 is equal to lambda times v1, v2. A times v1, v2, we can write it down. It's 0.99 v1 plus 0.01 v2. And that 0.8 v1 plus 0.2 v2, which is equal to v1, v2. You can solve v1 and v2, but before doing that-- sorry about that. This is flipped. Yeah, so everybody, it should have been flipped in the beginning. So that's 8. So sum these two values, and you get lambda of this, v1, v2. On the left, what you get is v1 plus v2, so sum two coordinates. On the left, you get v1 plus v2. On the right, you get lambda times v1 plus v2. That means your lambda is equal to 1. So that eigenvalue, guaranteed by Perron-Frobenius theorem, is 1, eigenvalue of 1. So what you'll find here will be the eigenvector corresponding to the largest eigenvalue-- eigenvector will be the one corresponding to the largest eigenvalue, which is equal to 1. And that's something very general. It's not just about this matrix and this special example. In general, if you have a transition matrix, if you're given a Markov chain and given a transition matrix, Perron-Frobenius theorem guarantees that there exists a vector as long as all the entries are positive. So in general, if transition matrix of a Markov chain has positive entries, then there exists a vector pi 1 equal to pi m such that-- I'll just call it v-- Av is equal to v. And that will be the long term behavior as explained. Over a long, if it converges to some state, it has to satisfy that. And by Perron-Frobenius theorem, we know that there is a vector satisfying it. So if it converges, it will converge to that. And what it's saying is, if all the entries are positive, then it converges. And there is such a state. We know the long-term behavior of the system. So this is called the stationary distribution. Such vector v is called. It's not really right to say that a vector has stationary distribution. But if I give this distribution to the state space, what I mean is consider probability distribution over s such that probability is-- so it's a random variable X-- X is equal to i is equal to pi i. If you start from this distribution, in the next step, you'll have the exact same distribution. That's what I'm trying to say here. That's called a stationary distribution. Any questions? AUDIENCE: So [INAUDIBLE]? PROFESSOR: Yes. Very good question. Yeah, but Perron-Frobenius theorem say there is exactly one eigenvector corresponding to the largest eigenvalue. And that turns out to be 1. The largest eigenvalue turns out to be 1. So there will a unique stationary distribution if all the entries are positive. AUDIENCE: [INAUDIBLE]? PROFESSOR: This one? AUDIENCE: [INAUDIBLE]? PROFESSOR: Maybe. It's a good point. Huh? Something is wrong. Can anybody help me? This part looks questionable. AUDIENCE: Just kind of [INAUDIBLE] question, is that topic covered in portions of [INAUDIBLE]? The other eigenvalues in the matrix are smaller than 1. And so when you take products of the transition probability matrix, those eigenvalues that are smaller than 1 scale after repeated multiplication to 0. So in the limit, they're 0, but until you get to the limit, you still have them. Essentially, that kind of behavior is transitionary behavior that dissipates. But the behavior corresponding to the stationary distribution persists. PROFESSOR: But, as you mentioned, this argument seems to be giving that all lambda has to be 1, right? Is that your point? You're right. I don't see what the problem is right now. I'll think about it later. I don't want to waste my time on trying to find what's wrong. But the conclusion is right. There will be a unique one and so on. Now let me make a note here. So let me move on to the final topic. It's called martingale. And this is another collection of stochastic processes. And what we're trying to model here is a fair game, stochastic processes which are a fair game. And formally, what I mean is a stochastic process is a martingale if that happens. Let me iterate it. So what we have here is, at time t, if you look at what's going to happen at time t plus 1, take the expectation, then it has to be exactly equal to the value of Xt. So we have this stochastic process, and, at time t, you are at Xt. At time t plus 1, lots of things can happen. It might go to this point, that point, that point, or so on. But the probability distribution is designed so that the expected value over all these are exactly equal to the value at Xt. So it's kind of centered at Xt, centered meaning in the probabilistic sense. The expectation is equal to that. So if your value at time t was something else, your values at time t plus 1 will be centered at this value instead of that value. And the reason I'm saying it models a fair game is because, if this is like your balance over some game, in expectation, you're not supposed to win any money at all And I will later tell you more about that. So example, a random walk is a martingale. What else? Second one, now let's say you're in a casino and you're playing roulette. Balance of a roulette player is not a martingale. Because it's designed so that the expected value is less than 0. You're supposed to lose money. Of course, at one instance, you might win money. But in expected value, you're designed to go down. So it's not a martingale. It's not a fair game. The game is designed for the casino not for you. Third one is some funny example. I just made it up to show that there are many possible ways that a stochastic process can be a martingale. So if Yi are IID random variables such that Yi is equal to 2, with probability 1/3, and 1/2 is probability 2/3, then let X0 equal 1 and Xk equal. Then that is a martingale. So at each step, you'll either multiply by 2 or 1/2 by 2-- just divide by 2. And the probability distribution is given as 1/3 and 2/3. Then Xk is a martingale. The reason is-- so you can compute the expected value. The expected value of the Xk plus 1, given Xk up to [INAUDIBLE], is equal to-- what you have is expected value of Y k plus 1 times Yk up to Y1. That part is Xk. But this is designed so that the expected value is equal to 1. So it's a martingale. I mean it will fluctuate a lot, your balance, double, double, double, half, half, half, and so on. But still, in expectation, you will always maintain. I mean the expectation that all time is equal to 1, if you look at it from the beginning. You look at time 1, then the expected value of x1 and so on. Any questions on definition or example? So the random walk is an example which is both Markov chain and martingale. But these two concepts are really two different concepts. Try not to be confused between the two. They're just two different things. There are Markov chains which are not martingales. There are martingales which are not Markov chains. And there are somethings which are both, like a simple random walk. There are some stuff which are not either of them. They really are just two separate things. Let me conclude with one interesting theorem about martingales. And it really enforces your intuition, at least intuition of the definition, that martingale is a fair game. It's called optional stopping theorem. And I will write it down more formally later, but the message is this. If you play a martingale game, if it's a game you play and it's your balance, no matter what strategy you use, your expected value cannot be positive or negative. Even if you try to lose money so hard, you won't be able to do that. Even if you try to win money so hare, like try to invent something really, really cool and ingenious, you should not be able to win money. Your expected value is just fixed. That's the concept of the theorem. Of course, there are technical conditions that have to be there. So if you're playing a martingale game, then you're not supposed to win or lose, at least in expectation. So before stating the theorem, I have to define what a stopping point means. So given a stochastic process, a non-negative integer, a valued random variable, tau, is called a stopping time, if, for all integer k greater than or equal to 0, tau, lesser or equal to k, depends only on X1 to Xk. So that is something very, very strange. I want to define something called a stopping time. It will be a non-negative integer valued random variable. So it will it be 0, 1, 2, or so on. That means it will be some time index. And if you look at the event that tau is less than or equal to k-- so if you want to look at the events when you stop at time less than or equal to k, your decision only depends on the events up to k, on the value of the stochastic process up to time k. In other words, if this is some strategy you want to use-- by strategy I mean some strategy that you stop playing at some point. You have a strategy that is defined as you play some k rounds, and then you look at the outcome. You say, OK, now I think it's in favor of me. I'm going to stop. You have a pre-defined set of strategies. And if that strategy only depends on the values of the stochastic process up to right now, then it's a stopping time. If it's some strategy that depends on future values, it's not a stopping time. Let me show you by example. Remember that coin toss game which had random walk value, so either win $1 or lose $1. So in coin toss game, let tau be the first time at which balance becomes $100, then tau is a stopping time. Or you stop at either $100 or negative $50, that's still a stopping time. Remember that we discussed about it? We look at our balance. We stop at either at the time when we win $100 or lose $50. That is a stopping time. But I think it's better to tell you what is not a stopping time, an example. That will help, really. So let tau-- in the same game-- the time of first peak. By peak, I mean the time when you go down, so that would be your tau. So the first time when you start to go down, you're going to stop. That's not a stopping time. Not a stopping time. To see formally why it's the case, first of all, if you want to decide if it's a peak or not at time t, you have to refer to the value at time t plus 1. For just looking at values up to time t, you don't know if it's going to be a peak or if it's going to continue. So the event that you stop at time t depends on t plus 1 as well, which doesn't fall into this definition. So that's what we're trying to distinguish by defining a stopping time. In these cases it was clear, at the time, you know if you have to stop or not. But if you define your stopping time in this way and not a stopping time, if you define tau in this way, your decision depends on future values of the outcome. So it's not a stopping time under this definition. Any questions? Does it make sense? Yes? AUDIENCE: Could you still have tau as the stopping time, if you were referring to t, and then t minus 1 was greater than [INAUDIBLE]? PROFESSOR: So. AUDIENCE: Let's say, yeah, it was [INAUDIBLE]. PROFESSOR: So that time after peak, the first time after peak? AUDIENCE: Yes. PROFESSOR: Yes, that will be a stopping time. So three, tau is tau 0 plus 1, where tau 0 is the first peak, then it is a stopping time. It's a stopping time. So the optional stopping theorem that I promised says the following. Suppose we have a martingale, and tau is a stopping time. And further suppose that there exists a constant t such that tau is less than or equal t always. So you have some strategy which is a finite strategy. You can't go on forever. You have some bound on the time. And your stopping time always ends before that time. In that case, then expectation of your value at the stopping time, when you've stopped, your balance, if that's what it's modeling, is always equal to the balance at the beginning. So no matter what strategy you use, if you're a mortal being, then you cannot win. That's the content of this theorem. So I wanted to prove it, but I'll not, because I think I'm running out of time. But let me show you one, very interesting corollary of this applied to that number one. So number one is a stopping time. It's not clear that there is a bounded time where you always stop before that time. But this theorem does apply to that case. So I'll just forget about that technical issue. So corollary, it applies not immediately, but it does apply to the first case, case 1 given above. And then what it says is expectation of X tau is equal to 0. But expectation of X tau is-- X at tau is either 100 or negative 50, because they're always going to stop at the first time where you either hit $100 or minus $50. So this is 100 times some probability plus 1 minus p times minus 50. There's some probability that you stop at 100. With all the rest, you're going to stop at minus 50. You know it's set. It's equal to 0. What it gives is-- I hope it gives me the right thing I'm thinking about. p, 100, yes. It's 150p minus 50 equals 0. p is 1/3. And if you remember, that was exactly the computation we got. So that's just a neat application. But the content of this, it's really interesting. So try to contemplate about it, something very philosophically. If something can be modeled using martingales, perfectly, if it really fits into the mathematical formulation of a martingale, then you're not supposed to win. So that's it for today. And next week, Peter will give wonderful lectures. See you next week.

Introduction

A stochastic or random process can be defined as a collection of random variables that is indexed by some mathematical set, meaning that each random variable of the stochastic process is uniquely associated with an element in the set.[4][5] The set used to index the random variables is called the index set. Historically, the index set was some subset of the real line, such as the natural numbers, giving the index set the interpretation of time.[1] Each random variable in the collection takes values from the same mathematical space known as the state space. This state space can be, for example, the integers, the real line or -dimensional Euclidean space.[1][5] An increment is the amount that a stochastic process changes between two index values, often interpreted as two points in time.[48][49] A stochastic process can have many outcomes, due to its randomness, and a single outcome of a stochastic process is called, among other names, a sample function or realization.[28][50]

Classifications

A stochastic process can be classified in different ways, for example, by its state space, its index set, or the dependence among the random variables. One common way of classification is by the cardinality of the index set and the state space.[51][52][53]

When interpreted as time, if the index set of a stochastic process has a finite or countable number of elements, such as a finite set of numbers, the set of integers, or the natural numbers, then the stochastic process is said to be in discrete time.[54][55] If the index set is some interval of the real line, then time is said to be continuous. The two types of stochastic processes are respectively referred to as discrete-time and continuous-time stochastic processes.[48][56][57] Discrete-time stochastic processes are considered easier to study because continuous-time processes require more advanced mathematical techniques and knowledge, particularly due to the index set being uncountable.[58][59] If the index set is the integers, or some subset of them, then the stochastic process can also be called a random sequence.[55]

If the state space is the integers or natural numbers, then the stochastic process is called a discrete or integer-valued stochastic process. If the state space is the real line, then the stochastic process is referred to as a real-valued stochastic process or a process with continuous state space. If the state space is -dimensional Euclidean space, then the stochastic process is called a -dimensional vector process or -vector process.[51][52]

Etymology

The word stochastic in English was originally used as an adjective with the definition "pertaining to conjecturing", and stemming from a Greek word meaning "to aim at a mark, guess", and the Oxford English Dictionary gives the year 1662 as its earliest occurrence.[60] In his work on probability Ars Conjectandi, originally published in Latin in 1713, Jakob Bernoulli used the phrase "Ars Conjectandi sive Stochastice", which has been translated to "the art of conjecturing or stochastics".[61] This phrase was used, with reference to Bernoulli, by Ladislaus Bortkiewicz[62] who in 1917 wrote in German the word stochastik with a sense meaning random. The term stochastic process first appeared in English in a 1934 paper by Joseph Doob.[60] For the term and a specific mathematical definition, Doob cited another 1934 paper, where the term stochastischer Prozeß was used in German by Aleksandr Khinchin,[63][64] though the German term had been used earlier, for example, by Andrei Kolmogorov in 1931.[65]

According to the Oxford English Dictionary, early occurrences of the word random in English with its current meaning, which relates to chance or luck, date back to the 16th century, while earlier recorded usages started in the 14th century as a noun meaning "impetuosity, great speed, force, or violence (in riding, running, striking, etc.)". The word itself comes from a Middle French word meaning "speed, haste", and it is probably derived from a French verb meaning "to run" or "to gallop". The first written appearance of the term random process pre-dates stochastic process, which the Oxford English Dictionary also gives as a synonym, and was used in an article by Francis Edgeworth published in 1888.[66]

Terminology

The definition of a stochastic process varies,[67] but a stochastic process is traditionally defined as a collection of random variables indexed by some set.[68][69] The terms random process and stochastic process are considered synonyms and are used interchangeably, without the index set being precisely specified.[27][29][30][70][71][72] Both "collection",[28][70] or "family" are used[4][73] while instead of "index set", sometimes the terms "parameter set"[28] or "parameter space"[30] are used.

The term random function is also used to refer to a stochastic or random process,[5][74][75] though sometimes it is only used when the stochastic process takes real values.[28][73] This term is also used when the index sets are mathematical spaces other than the real line,[5][76] while the terms stochastic process and random process are usually used when the index set is interpreted as time,[5][76][77] and other terms are used such as random field when the index set is -dimensional Euclidean space or a manifold.[5][28][30]

Notation

A stochastic process can be denoted, among other ways, by ,[56] ,[69] [78] or simply as . Some authors mistakenly write even though it is an abuse of function notation.[79] For example, or are used to refer to the random variable with the index , and not the entire stochastic process.[78] If the index set is , then one can write, for example, to denote the stochastic process.[29]

Examples

Bernoulli process

One of the simplest stochastic processes is the Bernoulli process,[80] which is a sequence of independent and identically distributed (iid) random variables, where each random variable takes either the value one or zero, say one with probability and zero with probability . This process can be linked to an idealisation of repeatedly flipping a coin, where the probability of obtaining a head is taken to be and its value is one, while the value of a tail is zero.[81] In other words, a Bernoulli process is a sequence of iid Bernoulli random variables,[82] where each idealised coin flip is an example of a Bernoulli trial.[83]

Random walk

Random walks are stochastic processes that are usually defined as sums of iid random variables or random vectors in Euclidean space, so they are processes that change in discrete time.[84][85][86][87][88] But some also use the term to refer to processes that change in continuous time,[89] particularly the Wiener process used in financial models, which has led to some confusion, resulting in its criticism.[90] There are other various types of random walks, defined so their state spaces can be other mathematical objects, such as lattices and groups, and in general they are highly studied and have many applications in different disciplines.[89][91]

A classic example of a random walk is known as the simple random walk, which is a stochastic process in discrete time with the integers as the state space, and is based on a Bernoulli process, where each Bernoulli variable takes either the value positive one or negative one. In other words, the simple random walk takes place on the integers, and its value increases by one with probability, say, , or decreases by one with probability , so the index set of this random walk is the natural numbers, while its state space is the integers. If , this random walk is called a symmetric random walk.[92][93]

Wiener process

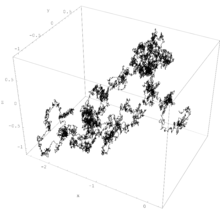

The Wiener process is a stochastic process with stationary and independent increments that are normally distributed based on the size of the increments.[2][94] The Wiener process is named after Norbert Wiener, who proved its mathematical existence, but the process is also called the Brownian motion process or just Brownian motion due to its historical connection as a model for Brownian movement in liquids.[95][96][97]

Playing a central role in the theory of probability, the Wiener process is often considered the most important and studied stochastic process, with connections to other stochastic processes.[1][2][3][98][99][100][101] Its index set and state space are the non-negative numbers and real numbers, respectively, so it has both continuous index set and states space.[102] But the process can be defined more generally so its state space can be -dimensional Euclidean space.[91][99][103] If the mean of any increment is zero, then the resulting Wiener or Brownian motion process is said to have zero drift. If the mean of the increment for any two points in time is equal to the time difference multiplied by some constant , which is a real number, then the resulting stochastic process is said to have drift .[104][105][106]

Almost surely, a sample path of a Wiener process is continuous everywhere but nowhere differentiable. It can be considered as a continuous version of the simple random walk.[49][105] The process arises as the mathematical limit of other stochastic processes such as certain random walks rescaled,[107][108] which is the subject of Donsker's theorem or invariance principle, also known as the functional central limit theorem.[109][110][111]

The Wiener process is a member of some important families of stochastic processes, including Markov processes, Lévy processes and Gaussian processes.[2][49] The process also has many applications and is the main stochastic process used in stochastic calculus.[112][113] It plays a central role in quantitative finance,[114][115] where it is used, for example, in the Black–Scholes–Merton model.[116] The process is also used in different fields, including the majority of natural sciences as well as some branches of social sciences, as a mathematical model for various random phenomena.[3][117][118]

Poisson process

The Poisson process is a stochastic process that has different forms and definitions.[119][120] It can be defined as a counting process, which is a stochastic process that represents the random number of points or events up to some time. The number of points of the process that are located in the interval from zero to some given time is a Poisson random variable that depends on that time and some parameter. This process has the natural numbers as its state space and the non-negative numbers as its index set. This process is also called the Poisson counting process, since it can be interpreted as an example of a counting process.[119]

If a Poisson process is defined with a single positive constant, then the process is called a homogeneous Poisson process.[119][121] The homogeneous Poisson process is a member of important classes of stochastic processes such as Markov processes and Lévy processes.[49]

The homogeneous Poisson process can be defined and generalized in different ways. It can be defined such that its index set is the real line, and this stochastic process is also called the stationary Poisson process.[122][123] If the parameter constant of the Poisson process is replaced with some non-negative integrable function of , the resulting process is called an inhomogeneous or nonhomogeneous Poisson process, where the average density of points of the process is no longer constant.[124] Serving as a fundamental process in queueing theory, the Poisson process is an important process for mathematical models, where it finds applications for models of events randomly occurring in certain time windows.[125][126]

Defined on the real line, the Poisson process can be interpreted as a stochastic process,[49][127] among other random objects.[128][129] But then it can be defined on the -dimensional Euclidean space or other mathematical spaces,[130] where it is often interpreted as a random set or a random counting measure, instead of a stochastic process.[128][129] In this setting, the Poisson process, also called the Poisson point process, is one of the most important objects in probability theory, both for applications and theoretical reasons.[22][131] But it has been remarked that the Poisson process does not receive as much attention as it should, partly due to it often being considered just on the real line, and not on other mathematical spaces.[131][132]

Definitions

Stochastic process

A stochastic process is defined as a collection of random variables defined on a common probability space , where is a sample space, is a -algebra, and is a probability measure; and the random variables, indexed by some set , all take values in the same mathematical space , which must be measurable with respect to some -algebra .[28]

In other words, for a given probability space and a measurable space , a stochastic process is a collection of -valued random variables, which can be written as:[80]

Historically, in many problems from the natural sciences a point had the meaning of time, so is a random variable representing a value observed at time .[133] A stochastic process can also be written as to reflect that it is actually a function of two variables, and .[28][134]

There are other ways to consider a stochastic process, with the above definition being considered the traditional one.[68][69] For example, a stochastic process can be interpreted or defined as a -valued random variable, where is the space of all the possible functions from the set into the space .[27][68] However this alternative definition as a "function-valued random variable" in general requires additional regularity assumptions to be well-defined.[135]

Index set

The set is called the index set[4][51] or parameter set[28][136] of the stochastic process. Often this set is some subset of the real line, such as the natural numbers or an interval, giving the set the interpretation of time.[1] In addition to these sets, the index set can be another set with a total order or a more general set,[1][54] such as the Cartesian plane or -dimensional Euclidean space, where an element can represent a point in space.[48][137] That said, many results and theorems are only possible for stochastic processes with a totally ordered index set.[138]

State space

The mathematical space of a stochastic process is called its state space. This mathematical space can be defined using integers, real lines, -dimensional Euclidean spaces, complex planes, or more abstract mathematical spaces. The state space is defined using elements that reflect the different values that the stochastic process can take.[1][5][28][51][56]

Sample function

A sample function is a single outcome of a stochastic process, so it is formed by taking a single possible value of each random variable of the stochastic process.[28][139] More precisely, if is a stochastic process, then for any point , the mapping

is called a sample function, a realization, or, particularly when is interpreted as time, a sample path of the stochastic process .[50] This means that for a fixed , there exists a sample function that maps the index set to the state space .[28] Other names for a sample function of a stochastic process include trajectory, path function[140] or path.[141]

Increment

An increment of a stochastic process is the difference between two random variables of the same stochastic process. For a stochastic process with an index set that can be interpreted as time, an increment is how much the stochastic process changes over a certain time period. For example, if is a stochastic process with state space and index set , then for any two non-negative numbers and such that , the difference is a -valued random variable known as an increment.[48][49] When interested in the increments, often the state space is the real line or the natural numbers, but it can be -dimensional Euclidean space or more abstract spaces such as Banach spaces.[49]

Further definitions

Law

For a stochastic process defined on the probability space , the law of stochastic process is defined as the image measure:

where is a probability measure, the symbol denotes function composition and is the pre-image of the measurable function or, equivalently, the -valued random variable , where is the space of all the possible -valued functions of , so the law of a stochastic process is a probability measure.[27][68][142][143]

For a measurable subset of , the pre-image of gives

so the law of a can be written as:[28]

The law of a stochastic process or a random variable is also called the probability law, probability distribution, or the distribution.[133][142][144][145][146]

Finite-dimensional probability distributions

For a stochastic process with law , its finite-dimensional distribution for is defined as:

This measure is the joint distribution of the random vector ; it can be viewed as a "projection" of the law onto a finite subset of .[27][147]

For any measurable subset of the -fold Cartesian power , the finite-dimensional distributions of a stochastic process can be written as:[28]

The finite-dimensional distributions of a stochastic process satisfy two mathematical conditions known as consistency conditions.[57]

Stationarity

Stationarity is a mathematical property that a stochastic process has when all the random variables of that stochastic process are identically distributed. In other words, if is a stationary stochastic process, then for any the random variable has the same distribution, which means that for any set of index set values , the corresponding random variables

all have the same probability distribution. The index set of a stationary stochastic process is usually interpreted as time, so it can be the integers or the real line.[148][149] But the concept of stationarity also exists for point processes and random fields, where the index set is not interpreted as time.[148][150][151]

When the index set can be interpreted as time, a stochastic process is said to be stationary if its finite-dimensional distributions are invariant under translations of time. This type of stochastic process can be used to describe a physical system that is in steady state, but still experiences random fluctuations.[148] The intuition behind stationarity is that as time passes the distribution of the stationary stochastic process remains the same.[152] A sequence of random variables forms a stationary stochastic process only if the random variables are identically distributed.[148]

A stochastic process with the above definition of stationarity is sometimes said to be strictly stationary, but there are other forms of stationarity. One example is when a discrete-time or continuous-time stochastic process is said to be stationary in the wide sense, then the process has a finite second moment for all and the covariance of the two random variables and depends only on the number for all .[152][153] Khinchin introduced the related concept of stationarity in the wide sense, which has other names including covariance stationarity or stationarity in the broad sense.[153][154]

Filtration

A filtration is an increasing sequence of sigma-algebras defined in relation to some probability space and an index set that has some total order relation, such as in the case of the index set being some subset of the real numbers. More formally, if a stochastic process has an index set with a total order, then a filtration , on a probability space is a family of sigma-algebras such that for all , where and denotes the total order of the index set .[51] With the concept of a filtration, it is possible to study the amount of information contained in a stochastic process at , which can be interpreted as time .[51][155] The intuition behind a filtration is that as time passes, more and more information on is known or available, which is captured in , resulting in finer and finer partitions of .[156][157]

Modification

A modification of a stochastic process is another stochastic process, which is closely related to the original stochastic process. More precisely, a stochastic process that has the same index set , state space , and probability space as another stochastic process is said to be a modification of if for all the following

holds. Two stochastic processes that are modifications of each other have the same finite-dimensional law[158] and they are said to be stochastically equivalent or equivalent.[159]

Instead of modification, the term version is also used,[150][160][161][162] however some authors use the term version when two stochastic processes have the same finite-dimensional distributions, but they may be defined on different probability spaces, so two processes that are modifications of each other, are also versions of each other, in the latter sense, but not the converse.[163][142]

If a continuous-time real-valued stochastic process meets certain moment conditions on its increments, then the Kolmogorov continuity theorem says that there exists a modification of this process that has continuous sample paths with probability one, so the stochastic process has a continuous modification or version.[161][162][164] The theorem can also be generalized to random fields so the index set is -dimensional Euclidean space[165] as well as to stochastic processes with metric spaces as their state spaces.[166]

Indistinguishable

Two stochastic processes and defined on the same probability space with the same index set and set space are said be indistinguishable if the following

holds.[142][158] If two and are modifications of each other and are almost surely continuous, then and are indistinguishable.[167]

Separability

Separability is a property of a stochastic process based on its index set in relation to the probability measure. The property is assumed so that functionals of stochastic processes or random fields with uncountable index sets can form random variables. For a stochastic process to be separable, in addition to other conditions, its index set must be a separable space,[b] which means that the index set has a dense countable subset.[150][168]

More precisely, a real-valued continuous-time stochastic process with a probability space is separable if its index set has a dense countable subset and there is a set of probability zero, so , such that for every open set and every closed set , the two events and differ from each other at most on a subset of .[169][170][171] The definition of separability[c] can also be stated for other index sets and state spaces,[174] such as in the case of random fields, where the index set as well as the state space can be -dimensional Euclidean space.[30][150]

The concept of separability of a stochastic process was introduced by Joseph Doob,.[168] The underlying idea of separability is to make a countable set of points of the index set determine the properties of the stochastic process.[172] Any stochastic process with a countable index set already meets the separability conditions, so discrete-time stochastic processes are always separable.[175] A theorem by Doob, sometimes known as Doob's separability theorem, says that any real-valued continuous-time stochastic process has a separable modification.[168][170][176] Versions of this theorem also exist for more general stochastic processes with index sets and state spaces other than the real line.[136]

Independence

Two stochastic processes and defined on the same probability space with the same index set are said be independent if for all and for every choice of epochs , the random vectors and are independent.[177]: p. 515

Two stochastic processes and are called uncorrelated if their cross-covariance is zero for all times.[178]: p. 142 Formally:

- .

If two stochastic processes and are independent, then they are also uncorrelated.[178]: p. 151

Orthogonality

Two stochastic processes and are called orthogonal if their cross-correlation is zero for all times.[178]: p. 142 Formally:

- .

Skorokhod space

A Skorokhod space, also written as Skorohod space, is a mathematical space of all the functions that are right-continuous with left limits, defined on some interval of the real line such as or , and take values on the real line or on some metric space.[179][180][181] Such functions are known as càdlàg or cadlag functions, based on the acronym of the French phrase continue à droite, limite à gauche.[179][182] A Skorokhod function space, introduced by Anatoliy Skorokhod,[181] is often denoted with the letter ,[179][180][181][182] so the function space is also referred to as space .[179][183][184] The notation of this function space can also include the interval on which all the càdlàg functions are defined, so, for example, denotes the space of càdlàg functions defined on the unit interval .[182][184][185]

Skorokhod function spaces are frequently used in the theory of stochastic processes because it often assumed that the sample functions of continuous-time stochastic processes belong to a Skorokhod space.[181][183] Such spaces contain continuous functions, which correspond to sample functions of the Wiener process. But the space also has functions with discontinuities, which means that the sample functions of stochastic processes with jumps, such as the Poisson process (on the real line), are also members of this space.[184][186]

Regularity

In the context of mathematical construction of stochastic processes, the term regularity is used when discussing and assuming certain conditions for a stochastic process to resolve possible construction issues.[187][188] For example, to study stochastic processes with uncountable index sets, it is assumed that the stochastic process adheres to some type of regularity condition such as the sample functions being continuous.[189][190]

Further examples

Markov processes and chains

Markov processes are stochastic processes, traditionally in discrete or continuous time, that have the Markov property, which means the next value of the Markov process depends on the current value, but it is conditionally independent of the previous values of the stochastic process. In other words, the behavior of the process in the future is stochastically independent of its behavior in the past, given the current state of the process.[191][192]

The Brownian motion process and the Poisson process (in one dimension) are both examples of Markov processes[193] in continuous time, while random walks on the integers and the gambler's ruin problem are examples of Markov processes in discrete time.[194][195]

A Markov chain is a type of Markov process that has either discrete state space or discrete index set (often representing time), but the precise definition of a Markov chain varies.[196] For example, it is common to define a Markov chain as a Markov process in either discrete or continuous time with a countable state space (thus regardless of the nature of time),[197][198][199][200] but it has been also common to define a Markov chain as having discrete time in either countable or continuous state space (thus regardless of the state space).[196] It has been argued that the first definition of a Markov chain, where it has discrete time, now tends to be used, despite the second definition having been used by researchers like Joseph Doob and Kai Lai Chung.[201]

Markov processes form an important class of stochastic processes and have applications in many areas.[39][202] For example, they are the basis for a general stochastic simulation method known as Markov chain Monte Carlo, which is used for simulating random objects with specific probability distributions, and has found application in Bayesian statistics.[203][204]

The concept of the Markov property was originally for stochastic processes in continuous and discrete time, but the property has been adapted for other index sets such as -dimensional Euclidean space, which results in collections of random variables known as Markov random fields.[205][206][207]

Martingale

A martingale is a discrete-time or continuous-time stochastic process with the property that, at every instant, given the current value and all the past values of the process, the conditional expectation of every future value is equal to the current value. In discrete time, if this property holds for the next value, then it holds for all future values. The exact mathematical definition of a martingale requires two other conditions coupled with the mathematical concept of a filtration, which is related to the intuition of increasing available information as time passes. Martingales are usually defined to be real-valued,[208][209][155] but they can also be complex-valued[210] or even more general.[211]

A symmetric random walk and a Wiener process (with zero drift) are both examples of martingales, respectively, in discrete and continuous time.[208][209] For a sequence of independent and identically distributed random variables with zero mean, the stochastic process formed from the successive partial sums is a discrete-time martingale.[212] In this aspect, discrete-time martingales generalize the idea of partial sums of independent random variables.[213]

Martingales can also be created from stochastic processes by applying some suitable transformations, which is the case for the homogeneous Poisson process (on the real line) resulting in a martingale called the compensated Poisson process.[209] Martingales can also be built from other martingales.[212] For example, there are martingales based on the martingale the Wiener process, forming continuous-time martingales.[208][214]

Martingales mathematically formalize the idea of a 'fair game' where it is possible form reasonable expectations for payoffs,[215] and they were originally developed to show that it is not possible to gain an 'unfair' advantage in such a game.[216] But now they are used in many areas of probability, which is one of the main reasons for studying them.[155][216][217] Many problems in probability have been solved by finding a martingale in the problem and studying it.[218] Martingales will converge, given some conditions on their moments, so they are often used to derive convergence results, due largely to martingale convergence theorems.[213][219][220]

Martingales have many applications in statistics, but it has been remarked that its use and application are not as widespread as it could be in the field of statistics, particularly statistical inference.[221] They have found applications in areas in probability theory such as queueing theory and Palm calculus[222] and other fields such as economics[223] and finance.[17]

Lévy process

Lévy processes are types of stochastic processes that can be considered as generalizations of random walks in continuous time.[49][224] These processes have many applications in fields such as finance, fluid mechanics, physics and biology.[225][226] The main defining characteristics of these processes are their stationarity and independence properties, so they were known as processes with stationary and independent increments. In other words, a stochastic process is a Lévy process if for non-negatives numbers, , the corresponding increments

are all independent of each other, and the distribution of each increment only depends on the difference in time.[49]

A Lévy process can be defined such that its state space is some abstract mathematical space, such as a Banach space, but the processes are often defined so that they take values in Euclidean space. The index set is the non-negative numbers, so , which gives the interpretation of time. Important stochastic processes such as the Wiener process, the homogeneous Poisson process (in one dimension), and subordinators are all Lévy processes.[49][224]

Random field

A random field is a collection of random variables indexed by a -dimensional Euclidean space or some manifold. In general, a random field can be considered an example of a stochastic or random process, where the index set is not necessarily a subset of the real line.[30] But there is a convention that an indexed collection of random variables is called a random field when the index has two or more dimensions.[5][28][227] If the specific definition of a stochastic process requires the index set to be a subset of the real line, then the random field can be considered as a generalization of stochastic process.[228]

Point process

A point process is a collection of points randomly located on some mathematical space such as the real line, -dimensional Euclidean space, or more abstract spaces. Sometimes the term point process is not preferred, as historically the word process denoted an evolution of some system in time, so a point process is also called a random point field.[229] There are different interpretations of a point process, such a random counting measure or a random set.[230][231] Some authors regard a point process and stochastic process as two different objects such that a point process is a random object that arises from or is associated with a stochastic process,[232][233] though it has been remarked that the difference between point processes and stochastic processes is not clear.[233]

Other authors consider a point process as a stochastic process, where the process is indexed by sets of the underlying space[d] on which it is defined, such as the real line or -dimensional Euclidean space.[236][237] Other stochastic processes such as renewal and counting processes are studied in the theory of point processes.[238][233]

History

Early probability theory

Probability theory has its origins in games of chance, which have a long history, with some games being played thousands of years ago,[239] but very little analysis on them was done in terms of probability.[240] The year 1654 is often considered the birth of probability theory when French mathematicians Pierre Fermat and Blaise Pascal had a written correspondence on probability, motivated by a gambling problem.[241][242] But there was earlier mathematical work done on the probability of gambling games such as Liber de Ludo Aleae by Gerolamo Cardano, written in the 16th century but posthumously published later in 1663.[243]

After Cardano, Jakob Bernoulli[e] wrote Ars Conjectandi, which is considered a significant event in the history of probability theory. Bernoulli's book was published, also posthumously, in 1713 and inspired many mathematicians to study probability.[245][246] But despite some renowned mathematicians contributing to probability theory, such as Pierre-Simon Laplace, Abraham de Moivre, Carl Gauss, Siméon Poisson and Pafnuty Chebyshev,[247][248] most of the mathematical community[f] did not consider probability theory to be part of mathematics until the 20th century.[247][249][250][251]

Statistical mechanics